If you’re starting to get your spending under control, you’re starting to take a look at the credit cards you have and figuring out a game plan. You’re thinking you might not want to get rid of them completely just in case your credit score needs a boost or just in case of emergencies, but you have the debt being paid and you’ve left them out of your wallet or purse to lessen impulse spending. Maybe you’re confused on what credit card has what balance. Or maybe you just need some encouragement. It’s time to do a little tidying!

That’s where the post-it notes come in. It’s always great to have just one card, but if you have multiple cards with different balances, the post-its can be used to write down what’s left on your cards. If you’re not using them, it’s a positive boost to see those numbers get lower as the months pass. Also, seeing the numbers on them gives you an overall idea of emergency credit. (Things happen sometimes!)

The post-its are also good for little affirmations to let you know you’re slowly climbing out of debt, even on the months that haven’t gone so well. Something just as small as a little “You can do it!” to remind yourself that an end is on the horizon helps.

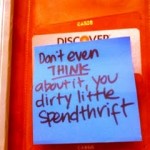

Or maybe you’re almost there and feel like you can start using them again. A note of “DON’T TOUCH ME!” might just make you think twice. Of course, keeping them completely out of your wallet is the best way to not spend! “For emergencies only” would also be a great way to stay away from the cards.

It’s all about keeping in mind the end goal of getting out of debt and not letting the world tell you to spend! Those little post-it notes can make a big impact in your quest to become debt-free.

Do you still carry your credit cards? Like us on Facebook and tell your story!